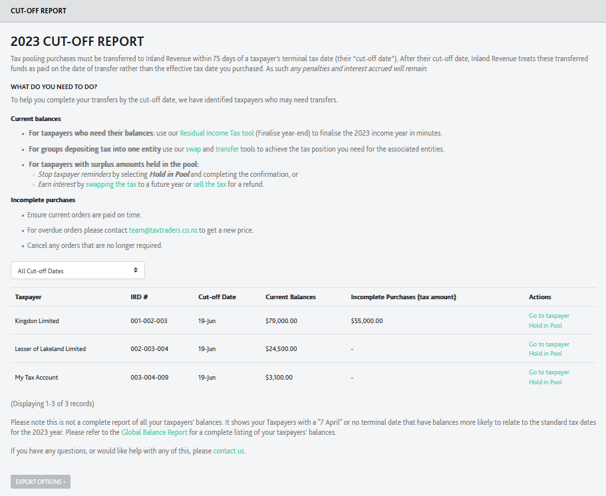

Use the Cut-off Report to complete transfers and avoid penalties and interest.

What is a cut-off date?

For a given tax year, all tax pooling purchases must be transferred to IR within 75 days of a taxpayer’s terminal tax date (their “cut-off date”). After a taxpayer's cut-off date, IR treats transfers of purchased tax as paid on the transfer date rather than the effective tax date you purchased. As such your taxpayers will have to pay for any penalties and interest on their account!

How can I keep track of all my taxpayers leading up to the cut-off date?

If you've got a large portfolio of taxpayers it's tough to remember all their arrangements and tax needs. That's why we created the Cut-off Report.

It provides a you with a list of taxpayers who have:

- Current tax balances held in the pool that may need to be transferred to IR (current balances), and

- Incomplete finance or buy in place for the current year (incomplete purchases).

We recommend you review the list and make transfers for those taxpayers who need their tax for the current tax year.

What do I do about current balances?

For individual taxpayers with current balances you can use our Residual Income Tax tool or Combined Report to calculate their transfers. For groups depositing tax into one entity use our swap and transfer tools to achieve the tax position you need for the associated entities.

If you have any remaining balances, selecting "Hold in pool" and completing the form will remove the taxpayer from the list.

What do I do about incomplete purchases?

For taxpayers, ensure current orders are paid on time (particularly those falling on the cut-off date!). For overdue orders please contact team@taxtraders.co.nz to get a new price and cancel any orders that are no longer required.

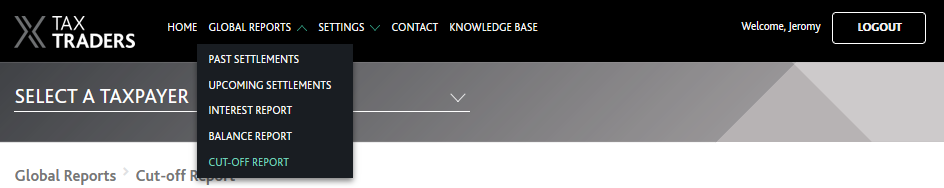

Where can I find the Cut-off Report?

You can find your cut-off report under Global Reports:

Related articles