IRD tax pooling indicator

When a client makes a deposit or puts in place an arrangement for a given tax year, Tax Traders notifies IRD about their intention to use tax pooling.

Whilst penalties and interest will still appear on the account until the arrangement is completed and processed, the IRD will not undergo debt enforcement action if the client has a tax pooling indicator on their account.

Check tax pooling status at IRD

- Search for taxpayer

- Access client

- In the income tax box, select ''More'' (as seen below)

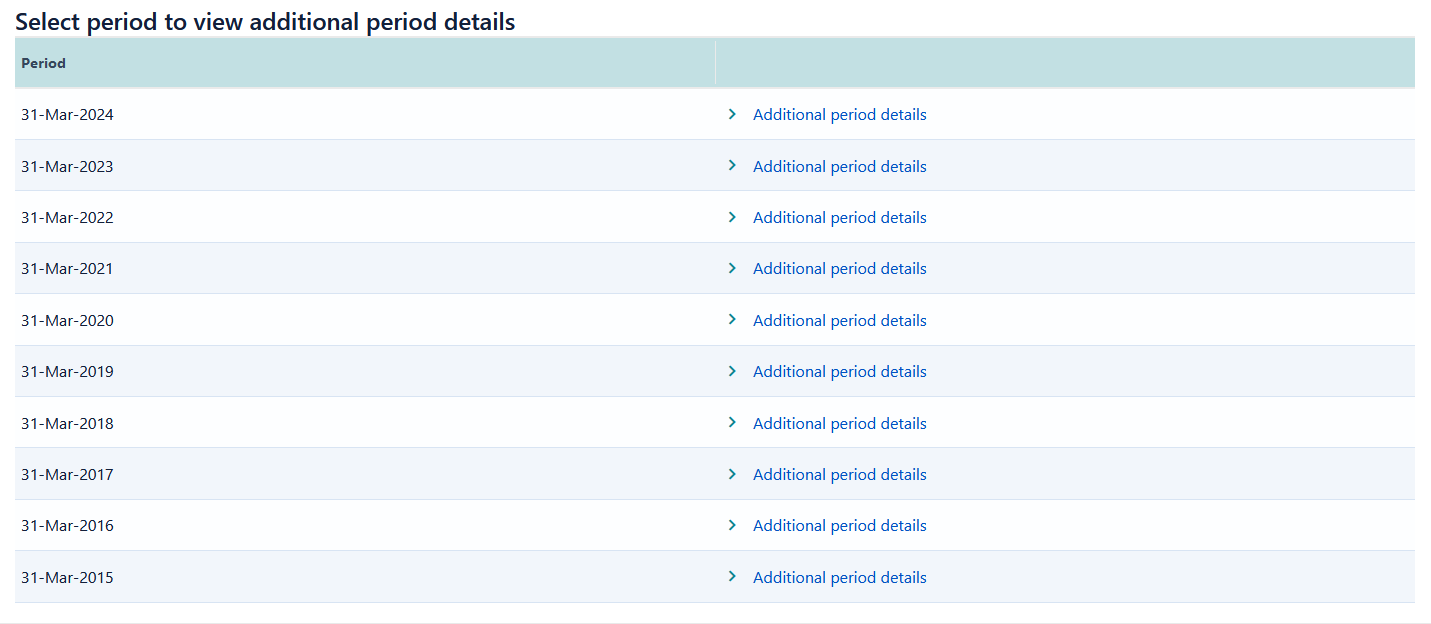

- Scroll right to the bottom, and under reports select ''Additional period details (it's the last

report on the page)

- Select the relevant period by selecting ''Additional period details''

- If the client has a tax pooling indicator applied to their account it will show here as a ''Yes'' under intention to use tax pooling, as follows.

If the intention to use tax pooling is ''No'' and the client has set up an arrangement with us for this period, please contact the team@taxtraders.co.nz and we will look into this for you.